Gold has been a symbol of wealth and prosperity for centuries. Among the various forms in which gold is traded and stored, bullion bars hold a special place. These solid gold bars, often referred to simply as gold bars, are a tangible representation of wealth and an important asset for investors worldwide. In this article, we will delve into the fascinating world of bullion bars, exploring their history, significance, and the reasons why they remain a preferred choice for investors.

A Brief History of Bullion Bars

The history of gold bars dates back to ancient civilizations, where gold was used as a medium of exchange and a store of value. The first standardized gold bars were produced in the Roman Empire, setting a precedent for the future. Over the centuries, the production and refinement of gold bars evolved, leading to the highly standardized bullion bars we see today.

What Are Bullion Bars?

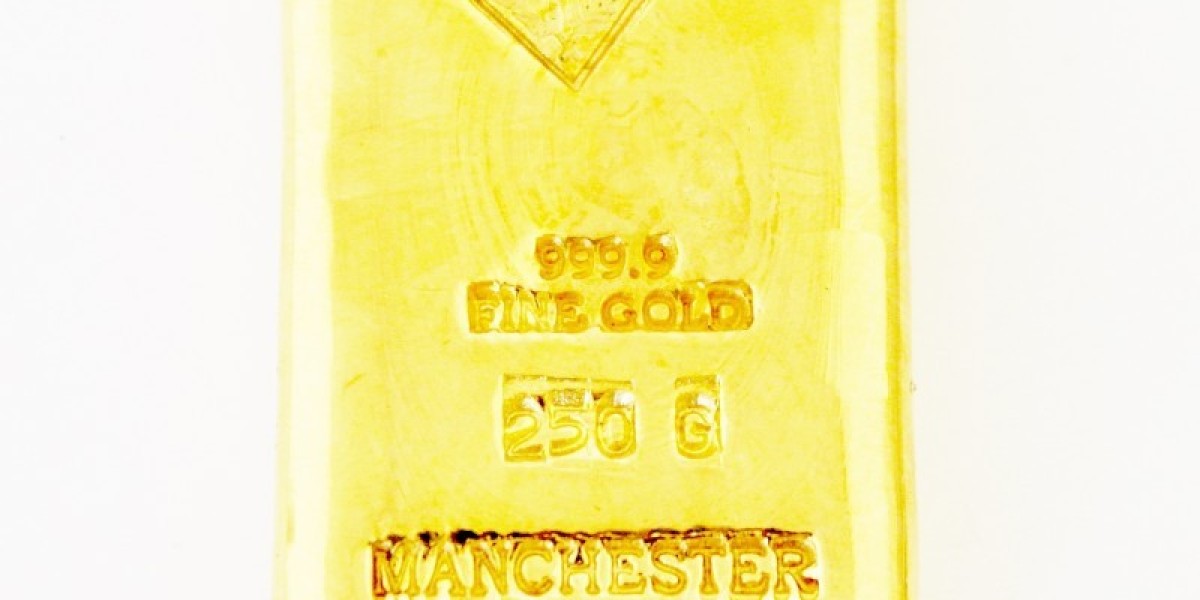

Bullion bars are refined metallic gold bars that are produced by bullion bars mints and refineries. These bars are typically 99.5% to 99.99% pure gold, making them a highly valuable asset. The weight of bullion bars can vary, ranging from as small as 1 gram to as large as 400 ounces, the latter often referred to as "good delivery" bars.

Why Invest in Bullion Bars?

Tangible Asset: Unlike stocks or bonds, bullion bars are a physical asset that you can hold in your hand. This tangibility provides a sense of security and permanence.

Inflation Hedge: Gold has historically been a hedge against inflation. When the value of currency declines, the value of gold often rises, making bullion bars a valuable asset in uncertain economic times.

Liquidity: Bullion bars are highly liquid assets. They can be easily bought and sold in the global market, ensuring that investors can access their value when needed.

Diversification: Including bullion bars in an investment portfolio can provide diversification, reducing risk by balancing other asset classes.

Types of Bullion Bars

Bullion bars come in various sizes and weights, catering to different investment needs. The most common types include:

- Small Bars: These bars, ranging from 1 gram to 100 grams, are popular among individual investors due to their affordability and ease of storage.

- Medium Bars: Weighing between 100 grams and 1 kilogram, these bars offer a balance between size and value.

- Large Bars: These include the standard 400-ounce "good delivery" bars, typically used by institutional investors and central banks.

How to Buy Bullion Bars

Purchasing bullion bars involves several steps to ensure authenticity and value:

Choose a Reputable Dealer: Buy from a well-established dealer with a good reputation to ensure you are getting genuine gold bars.

Check for Certification: Look for bars that come with certification from recognized mints or refineries, such as the London Bullion Market Association (LBMA).

Consider Storage Options: Decide whether to store the gold bars at home, in a bank safety deposit box, or with a professional storage service.

Understand Pricing: Gold bars are priced based on the current market price of gold plus a premium for manufacturing and distribution. Compare prices to get the best deal.

Conclusion

Bullion bars represent a timeless investment that continues to attract investors due to their intrinsic value and stability. Whether you are a seasoned investor or a newcomer to the world of precious metals, understanding the benefits and nuances of bullion bars can help you make informed decisions and secure your financial future. As gold continues to glitter, bullion bars remain a solid cornerstone in the world of investment.